Breaking barriers and setting records, Tether, the issuer of USDT, raked in an impressive $4.5 billion in net profits during the first quarter of 2024.

Tether’s latest assurance report, released by BDO on May 1, has revealed some staggering numbers. The digital asset firm’s Treasury bills stockpile has soared to a record-breaking $90 billion, while their total net equity has surpassed $11.3 billion thanks to their diverse operations.

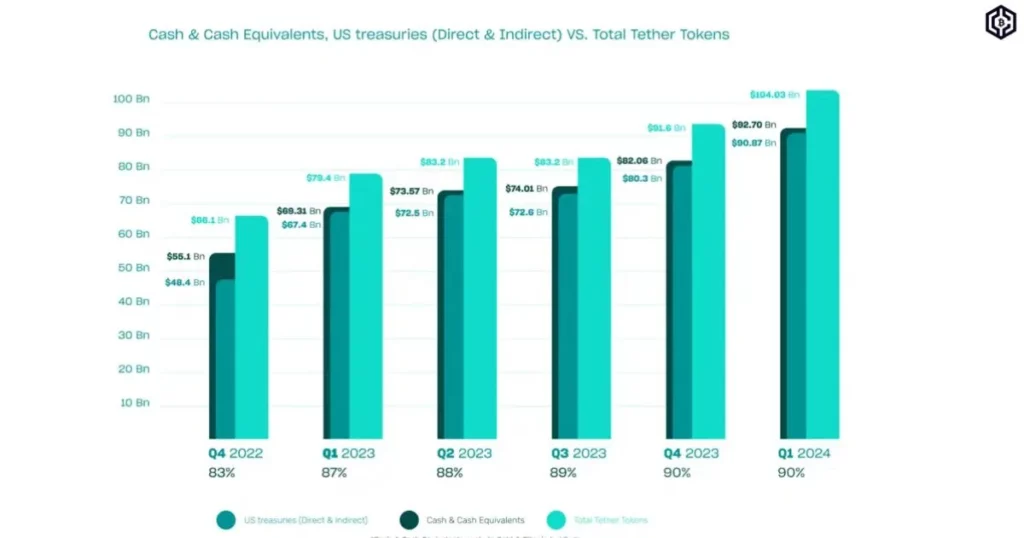

This attestation also highlights the impressive growth of Tether’s USDT provider ownership in U.S. Treasuries and net equity, which have skyrocketed from $80 billion and $7 billion in the fourth quarter of last year.

In a stunning revelation, the latest report has unveiled that a staggering $1 billion in profits has been raked in by this company through their innovative stablecoin issuing entities and savvy reserve management strategies. But here’s the twist: while a major chunk of the profits were generated from holding U.S. Treasuries, the rest came from their shrewd investments in Bitcoin (BTC) and Gold.

Experience the groundbreaking achievement of Tether as their fiat-pegged stablecoins reach an unprecedented 90% backing in cash and cash equivalents.

Exclusive: Trader Earns $26 Million by Investing in Solana Meme Token

Crypto Weekly Roundup: Tesla Holds BTC, Cosmos Vulnerability Patched, and More

Tesla Holds $184 million in Bitcoin

According to Tether CEO Paolo Ardoino, this milestone is a testament to their unwavering commitment to responsible risk management, solidifying their position as a leader in the ever-evolving world of cryptocurrency and stablecoins.

According to CoinGecko’s latest data, USDT reigns supreme as the top U.S. dollar-pegged stablecoin, boasting a staggering market capitalization of over $110 billion. This puts it in the ranks of the top three cryptocurrencies, trailing only behind the mighty Bitcoin and Ethereum (ETH).

“Tether is again raising the bar in the cryptocurrency industry in the realms of transparency and trust.”

Paolo Ardoino, Tether CEO