CoinGecko’s Explosive Report on the First Quarter’s Astonishing Growth in Sector Capitalization

The crypto world was on fire in the first quarter, as revealed by a sizzling report from CoinGecko. With a staggering 64.5% growth, the market’s capitalization skyrocketed to a record-breaking $2.9 trillion in March.

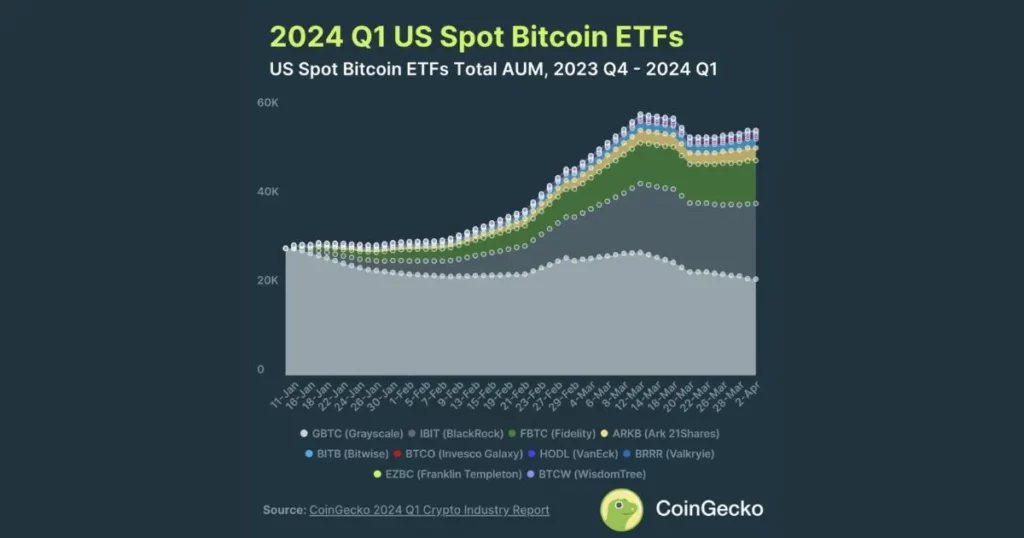

This impressive surge of $1.1 trillion left the previous quarter’s increase of $0.61 trillion in the dust. The spot Bitcoin ETFs, approved on Jan. 10, saw a massive influx of capital during this period, fueling the market’s explosive growth.

The crypto market was on fire from late January to mid-March, with the capitalization rate soaring to an all-time high. According to CoinGecko’s top analysts, the U.S. Spot Bitcoin ETFs saw a staggering growth in assets under management, reaching a whopping $55.1 billion.

While the Grayscale Bitcoin Trust ETF (GBTC) still reigns supreme, the iShares Bitcoin Trust (IBIT) and Fidelity Wise Origin Bitcoin Fund (FBTC) have been making waves, closing in on the top spot.

Breaking records and defying expectations, Bitcoin has soared an impressive 68.8% in the last quarter, reaching an all-time high. In a mere month, the market capitalization skyrocketed by 16.3%, as reported by Binance Research.

Exclusive: Hong Kong to reportedly be first to approve Bitcoin, Ethereum ETF

Bitcoin Struggles at $70k One Week from Halving

Analyst Estimates XRP Price Will Most Likely Fall During This Bullish Period

Despite a slight slowdown in capital inflow towards spot Bitcoin ETFs towards the end of March, funds continued to show promising growth. In fact, since the start of the year, Bitcoin exchange-traded funds have amassed a staggering $12 billion in investments.