“The EUR/USD pair has been locked in a fierce battle at the 1.10 level for the past month, unable to break through and claim victory. However, the tide may be turning as the European Central Bank (ECB) has hinted at potential interest rate cuts in the near future. This could mark the beginning of a new chapter for this pair, with the bullish trend potentially giving way to a new direction. Keep your eyes peeled for the ECB’s next move, as it could have a major impact on the EUR/USD’s fate.”

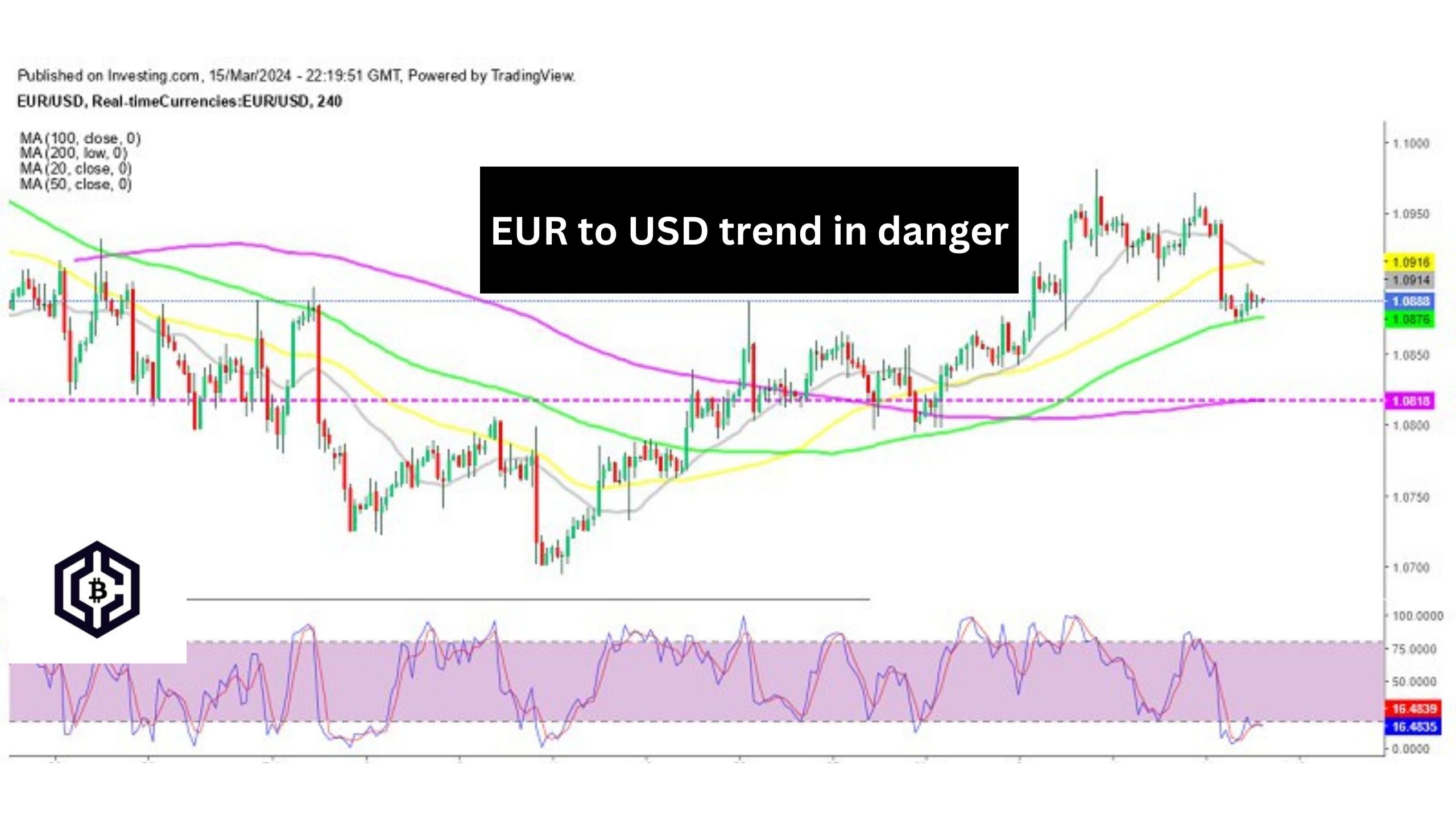

EUR/USD H4 Chart – MAs Are Still Holding As Support

“Despite a strong showing for the past month, the EUR/USD seemed to hit a roadblock last week as it struggled to break above the 1.10 mark. And just when it seemed like buyers were losing their momentum, a sudden reversal sent the Euro plunging over 100 pips lower. But don’t count the Euro out just yet – moving averages are still providing support and keeping the price in check. Will the Euro be able to bounce back or will it continue its downward spiral? Only time will tell.”

“Whispers of a potential June rate cut by the European Central Bank have sent ripples through the currency world, causing the Euro to lose its strength against the mighty US dollar. The mere mention of a possible easing of monetary policy by ECB officials has sparked a frenzy in the forex market, resulting in a decline of the Euro’s value.”

“The US dollar was on a roll this week, fueled by a surge in the Producer Price Index (PPI) that surpassed all expectations. This further solidified the market’s optimistic stance on interest rates, following last week’s impressive CPI inflation report. As a result, the EUR/USD pair took a nosedive, hitting a low of 1.0873. However, the 100 SMA (green) came to the rescue, providing a strong support for the euro.”

The EUR/USD pair made a valiant effort to rebound from the 100-period Simple Moving Average (SMA) on the 4-hour (H4) chart last Friday. But despite their best efforts, the buyers couldn’t keep the momentum going and the price remained stubbornly below the 1.09 mark. This struggle to break through the resistance at 1.09 hints at a lack of confidence from buyers, possibly signaling a bearish outlook for the EUR/USD pair.