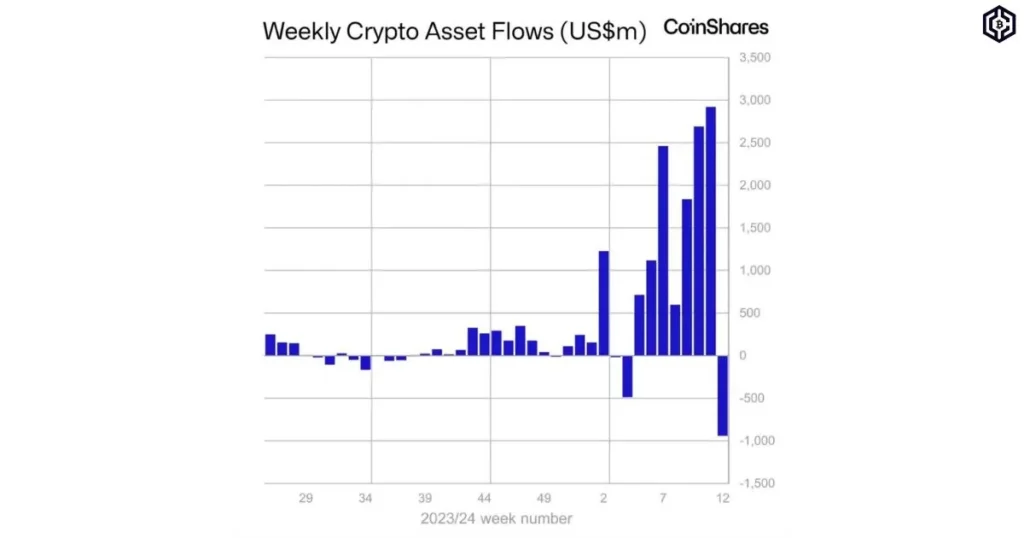

From a record-breaking inflow of $2.92 billion to a staggering outflow of $942 million, the crypto investment market has been on a wild ride from March 16 to 22.

CoinShares experts report a remarkable seven-week streak of positive growth. In just a short span of time, a whopping $12.3 billion flowed into various investment instruments.

With a trade turnover of $28 billion, following a record-breaking $43 billion the week before, the market is buzzing with excitement.

“The recent market turbulence can be attributed to a major shift in investments, with a staggering $2 billion being pulled out from Grayscale’s GBTC. This surpassed the $1.1 billion inflow to its competitors, causing a ripple effect among market participants.

A whopping $904 million was withdrawn from Bitcoin-related instruments, following the previous week’s record-breaking influx of $2.86 billion.

Market turbulence sent shockwaves through the digital asset world, causing a $10 billion decline in assets under management, now standing at $88.2 billion.

Just a mere week ago, this metric had soared past the $100 billion mark. But with the recent drop in quotes, investors were quick to take advantage of short positions on BTC, cashing out a whopping $3.7 million.

This comes after a record-breaking investment of $26 million in the previous seven days, making for a rollercoaster ride in the world of digital assets.”

Ethereum (ETH) saw a surge in outflow, jumping from $13.9 million to $34.2 million. As investors made moves, $5.6 million and $3.7 million were pulled out from Solana (SOL) and Cardano (ADA) instruments, respectively.

However, it wasn’t all bad news for the crypto world. Other popular currencies like Polkadot (DOT), Avalanche (AVA), and Litecoin (LTC) experienced a boost in inflow, with $5 million, $2.9 million, and $2 million pouring in, respectively.

Exclusive: SEC Chair Gary Gensler Says Crypto Industry Needs ‘Disinfectant’ – Here’s reason

Alex Thorn Says Spot Ethereum ETF Approval In May Unlikely

Crypto market slumps 8% as Bitcoin ETF outflows exceed $836m, in March End!

Breaking records yet again, the cryptocurrency market saw a staggering $2.92 billion in investment inflows last week, surpassing the previous reporting period’s $2.69 billion.

This brings the total inflow for the year to an impressive $13.2 billion. To put this into perspective, the entire year of 2021 only saw $10.6 billion in inflows.