“Breaking News: Cryptocurrency Market Takes a Dive, Losing $220 Billion in Just One Week! But Don’t Panic – Exciting New Market Opportunities Arise!”

Why is the crypto market down this week?

“The cryptocurrency world has been shaken this week, with the global market cap taking a steep 8.3% dip. The culprit? Bitcoin ETF outflows and a wave of liquidations in the derivatives market. However, hope glimmered on March 21 as the market hinted at a possible comeback. The U.S. Federal Reserve’s decision to pause interest rates for the third time in a row may have contributed to this, despite a surprise rise in inflation rates for February 2024. Will the crypto market bounce back or will it continue to face challenges? Only time will tell.”

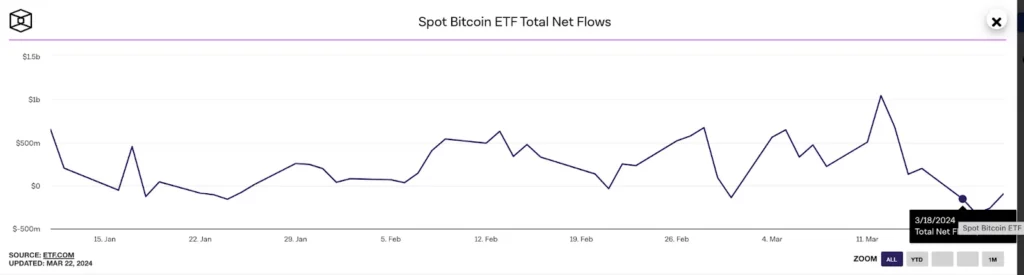

In a mere 48 hours, the market’s brief celebration over the rate pause came to a crushing halt as the relentless outflow of Bitcoin ETFs, spearheaded by Grayscale redemptions, added fuel to the already bearish fire. The Block’s insightful ETF NetFlow’s chart paints a clear picture of the daily tug-of-war between deposits and withdrawals among the 11 approved Bitcoin ETFs.

“Bitcoin ETFs have hit a rough patch, with four consecutive days of negative flows, as reported by ETF.com. The start of the week on March 18th saw a staggering $836 million in capital stock lost from the 11 approved ETFs. Will this downward trend continue or will the market bounce back? Stay tuned to find out.”

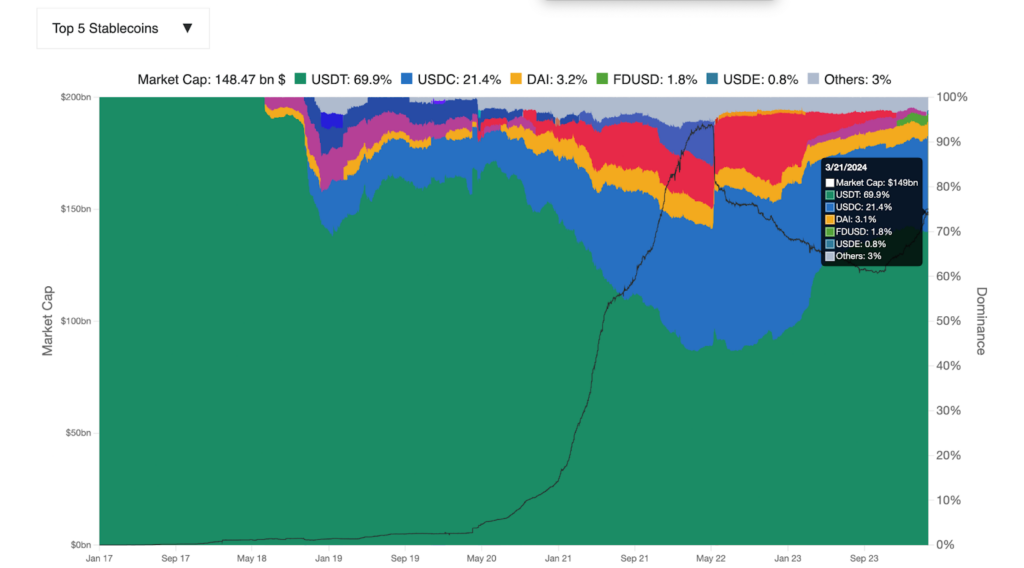

Top 5 stablecoins market cap hits $150b

“Excitingly, amidst an 8% market downturn, the latest on-chain data reveals promising signs of a bullish comeback. The numbers are glowing with potential, hinting at a bright future for investors.”

The world of stablecoins has been buzzing with excitement this week, as major milestones have been reached. Tether’s USDT made headlines by becoming the first stablecoin to reach a whopping $100 billion market cap, but it’s not the only one making waves. Other top-ranked stablecoins are also experiencing bullish trends, sparking even more excitement in the sector.

“Breaking records and making waves in the world of cryptocurrency, the top 5 stablecoins have reached a monumental milestone on March 21st – a combined market capitalization of a whopping 150 billion dollars! This marks the highest point since May 2022, leaving investors and enthusiasts buzzing with excitement. Leading the pack is the unstoppable USDT, now claiming an impressive 69.6% dominance in the market with a valuation of $105 billion. Trailing behind is Circle’s USDC with a distant second place and a market cap of $32 billion.

What happens next?

“The recent market dip has caused a stir as highly-leveraged positions have taken a hit, bringing a much-needed coolness to the previously overheated market. However, amidst this downturn, a glimmer of hope shines through with record-breaking stablecoin inflows, painting a more optimistic picture.

Typically, during a market pullback, an influx of stablecoins can be interpreted as a bullish sign for a variety of reasons.

For one, the surge in stablecoin activity during a market downturn can be seen as a classic ‘flight to safety’, indicating that investors are seeking refuge and stability rather than fleeing the market altogether. This suggests a level of confidence and resilience in the face of uncertainty.”