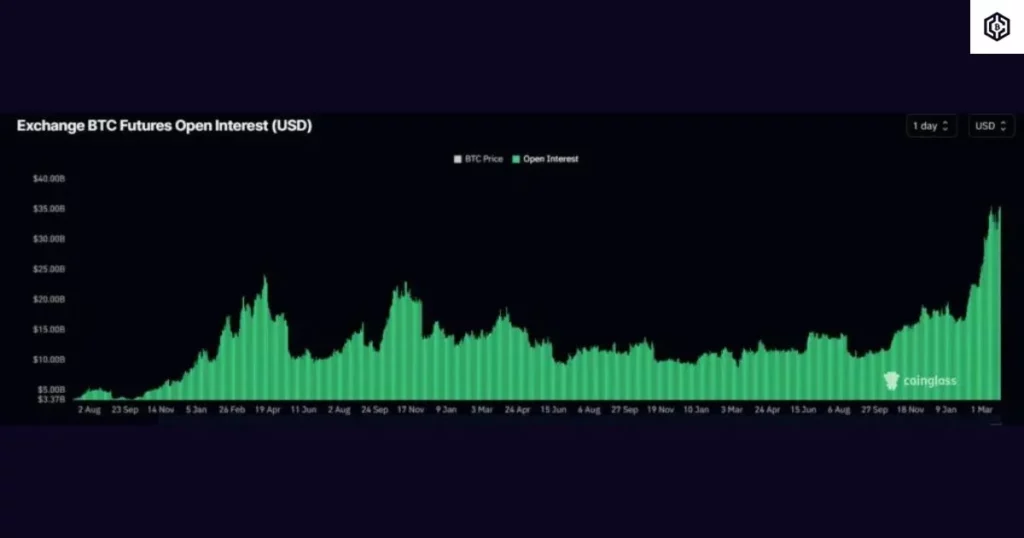

Bitcoin futures have exploded with a staggering $38 billion in open interest, fueled by a jaw-dropping 10% surge in BTC price this week. The crypto world is buzzing with excitement as investors eagerly anticipate what’s to come.

Bitcoin fever is spreading like wildfire as investors flock to the digital currency, eagerly anticipating its future price movements. Binance, the top player in the cryptocurrency game, just hit a record-breaking $8.4 billion in BTC open interest. The excitement and speculation surrounding Bitcoin have never been higher.

The cryptocurrency world is buzzing with excitement as Bitcoin futures witness an unprecedented surge in open interest. But that’s not all – brace yourselves for a wild ride as $15.1 billion worth of Bitcoin and Ethereum options are set to expire today, potentially causing a major stir in the market.

Traders are on edge as options expirations have a history of triggering significant price swings, and with such a massive amount of contracts expiring, the potential for explosive market activity is undeniable.

The surge in futures open interest aligns perfectly with a major options expiry, signaling a surge in trading fervor and speculation. All eyes are on the market as we eagerly anticipate its response to these thrilling developments.

Exclusive: “Rich Dad Poor Dad” author announces intention to buy Bitcoin before halving event

Is Ethereum making a comeback after a week-long decline?

The price of Bitcoin (BTC) is at a critical point

The world of cryptocurrency is abuzz with anticipation as a significant open interest in futures contracts reveals that countless individuals are placing their bets on Bitcoin’s future price direction. With a massive options expiry on the horizon, the market is bracing for short-term price fluctuations as contracts are settled.

This pivotal moment is not only crucial for retail investors, but also for institutional players who have a vested interest in the cryptocurrency market.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.