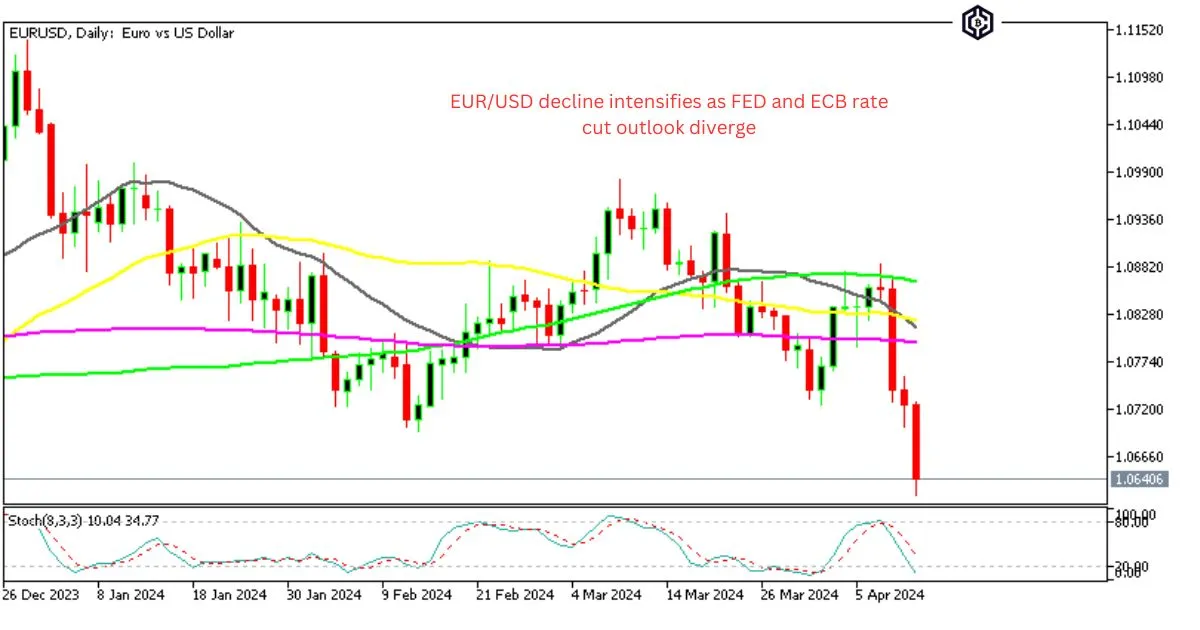

The battle of the currencies was in full force this week as the EUR took a hit, dropping over 2 cents against the USD. The FED and ECB’s interest rate plans have caused a rift, with predictions of more rate cuts from the ECB than the FED by 2024. The EUR/USD duo started the week on a low note, trading below 1.09 on Monday, but ended with a dramatic close at 1.0640 on Friday.

EUR/USD Chart Daily – The Lower Highs Signalled the Decline

The Euro’s recent journey in the financial world has been a rollercoaster ride, with twists and turns that have left investors on the edge of their seats. In the past three days alone, the Euro has taken a nosedive, fueled by a clash between the bold Federal Reserve and the cautious European Central Bank. This intense battle has caused the EUR/USD to plummet a staggering 2 cents, making it the most dramatic drop in almost a year.

The once reliable 1.0720 support has now turned against us, acting as a formidable barrier. With cunning sellers setting their sights on the 1.06-1.0630 and 1.05-1.0520 range, brace yourself for potential support zones.

Last Friday, the European Central Bank was buzzing with speculation as numerous members delivered surprisingly dovish remarks. The air was thick with anticipation as they hinted at the possibility of an interest rate cut in June. One member in particular, Muller, made a bold statement linking slower inflation to a potential rate cut. This sentiment was echoed by other members, revealing a collective willingness to take decisive monetary action in response to the concerning decline in inflation.

FED Members Highlight a Hawksih Outlook Comments from FED Member Mary Daly

- Amidst the current economic boom, Daly recognizes the impressive state of the labor market. However, she raises a cautionary flag as inflation continues to hold its ground, refusing to decrease at the same rate as last year.

- Daly emphasizes the Federal Reserve’s approach to decision-making, which goes beyond relying on one solitary data point, such as the CPI report. Instead, it underscores the significance of taking into account a multitude of factors when shaping monetary policies.

- Daly emphasizes the criticality of unwavering certainty in the trajectory of inflation, before even contemplating a potential rate cut. This reveals a prudent and meticulous approach to managing monetary policy, with a steadfast determination to attain optimal price stability.

- Daly underscores the significance of looking beyond mere numbers and instead, prioritizing the broader economic objectives. This signals a strong commitment to aligning monetary actions with the Fed’s ultimate goals of achieving maximum employment and maintaining stable prices.

Exclusive: Montenegrin court once again approves Do Kwon’s extradition

Bitcoin (BTC) remains strong despite poor US CPI data

Ethereum (ETH) whale transactions surge amid price correction, what next?

Fed’s Bostic’s Comment

Bostic grudgingly admits that inflation is set to ease, but at a sluggish pace that falls short of expectations. This suggests that the economy is still grappling with inflationary forces, though they’re not quite at the desired level.