Amidst the tumultuous world stage, the EUR/USD currency pair has taken a sharp turn towards the bear side, with the euro struggling against the mighty US dollar. The past few days have witnessed a storm of events, from escalating tensions in the Middle East to a rollercoaster of market fluctuations, all playing a role in the currency’s downward spiral.

The US dollar is riding high on a wave of confidence, thanks to a surge in inflation that has investors anticipating stricter monetary policies. Adding to the excitement is the Federal Reserve’s careful approach, along with disappointing economic reports from Germany and rising global tensions, all of which have played a role in the decline of the EUR/USD currency duo.

Weak German Data and Its Impact on EUR/USD

In addition to this, the gloomy economic news from Germany has cast a dark cloud over the EUR/USD currency pair. Disappointing figures for German industrial orders and factory data have dashed the hopes of economists, signaling a downturn in the country’s manufacturing industry. Shockingly, industrial orders plummeted by a staggering 10.6% in February, while factory orders barely inched up by a mere 0.2%, falling short of expectations.

The sluggish state of the German economy has sparked widespread concern for the overall health of the Eurozone. As the largest economy in the region, Germany’s lackluster performance has investors on edge, fearing a ripple effect on the entire Eurozone. This has put immense pressure on the shared currency, with the EUR/USD currency pair feeling the weight of selling pressure and succumbing to a bearish trend.

Cautious Fed Stance and US Initial Jobless Claims: Impact on EUR/USD

Across the pond, the Federal Reserve’s cautious approach and underwhelming US economic performance have cast a spell on the EUR/USD currency pair. While there was buzz about possible interest rate slashes, the latest remarks from Fed officials have put a damper on those speculations. In fact, some decision-makers have hinted that if inflation stays in check, there may not be any need for rate cuts until 2024.

Additionally, US initial jobless claims have surged to 221,000, surpassing expectations. This unexpected turn of events has sparked a wave of uncertainty, causing investors to flock towards the safety of the US dollar as a reliable refuge in these uncertain times.

Exclusive: Bitcoin futures open interest hits record $36 billion ahead of options expiration

Shocking: Crypto industry losses to hacking decreased by 23% in Q1

Breaking: Bitwise CIO predicts $1T BTC inflow via ETFs from institutional investors

EUR/USD Price Forecast: Technical Outlook

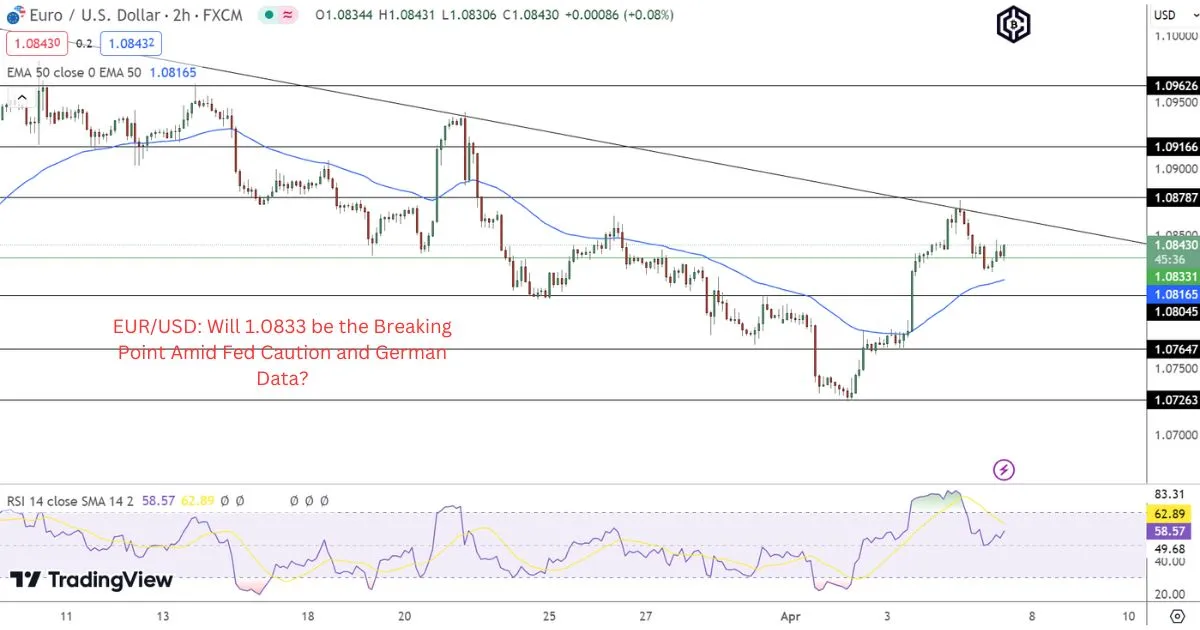

The highly anticipated EUR/USD duo maintains its composure at 1.08430, displaying only slight fluctuations. All eyes are on the pivotal point of 1.0833, signaling a bullish outlook if it remains above, but a potential downturn if it falls below. The currency pair faces formidable resistance at 1.0879, 1.0917, and 1.0963, while finding support at 1.0805, 1.0765, and 1.0726.

The Relative Strength Index (RSI) stands at a confident 58, signaling a steady momentum. Meanwhile, the 50-day Exponential Moving Average (EMA) sits at 1.0817, in perfect harmony with the pivot point, solidifying the current bullish trend.