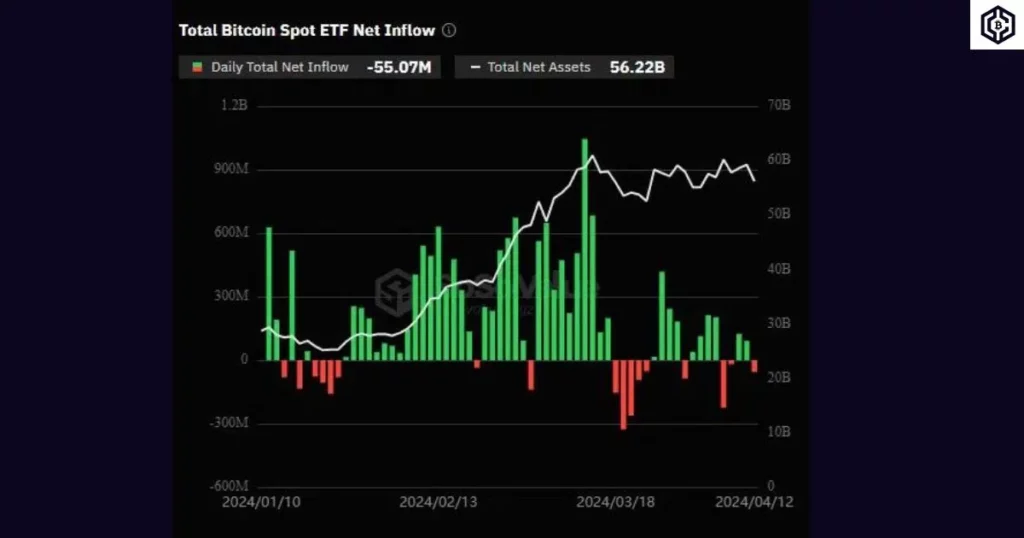

Bitcoin ETFs Take a Hit: Investors Pull Out $55 Million in a Single Day on April 12

Bitcoin ETFs ahead of halving

Friday saw a major shakeup in the world of cryptocurrency, with a whopping $166 million withdrawn from Grayscale’s GBTC, according to data from SoSo Value.

This trend of large outflows from GBTC in anticipation of the halving continued on Monday, April 8, with an additional $154.9 million being shed. But amidst all this movement, there was one shining star – BlackRock IBIT, which attracted a massive $111 million in the largest inflow of the day.

The crypto world was rocked by Friday’s outflow, leaving a trail of chaos in its wake. Bitcoin, the king of all digital currencies, took a hit of almost 5% in just 24 hours, plummeting to a low of $65,000. But it wasn’t just Bitcoin that felt the sting of this market shake-up.

The entire crypto market felt the impact, with a staggering $900 million being liquidated. And as if that wasn’t enough, the highly anticipated Bitcoin ETFs also saw a three-day streak of outflow, with a whopping $298.4 million being pulled out of the market.

Amidst a steady stream of departures from GBTC, Grayscale’s fearless leader, CEO Michael Sonneshein, remains steadfast in his positivity. In a recent statement, Sonneshein confidently declared that the tide of withdrawals from GBTC has finally reached a steady state. He predicts that the outflow will soon come to a halt as Grayscale offers reduced fees for their Bitcoin ETF.

Exclusive: Binance to be delisted, trading on six spot pairs to be halted

Bitcoin (BTC) Hangs on at $69,000 – Next Price Move Coming

Grayscale’s Bitcoin ETF Bleeds Before Halving Event

As the countdown to the highly anticipated Bitcoin halving begins, the ETF market is experiencing a steady stream of outflows. Some experts believe it could be a pre-halving pullback, fueled by the widespread belief that the halving will kick off a major bull market for the leading cryptocurrency.

In this game of profit-taking and reinvestment, investors are strategically cashing out in the short-term, only to jump back in when the market takes a dip.

Excitement and uncertainty swirl around the upcoming halving event for Bitcoin. While some investors eagerly anticipate a surge in value, others remain skeptical due to recent predictions from Marathon Digital. Their claim that BTC has already hit its peak following the approval of ETFs has left many wondering.